AS consumers troop to petroleum stations this week, they will be bracing for mixed emotions as the price of diesel will be on rollback; while the price of gasoline will be for a marginal increase, based on the calculation of the oil companies.

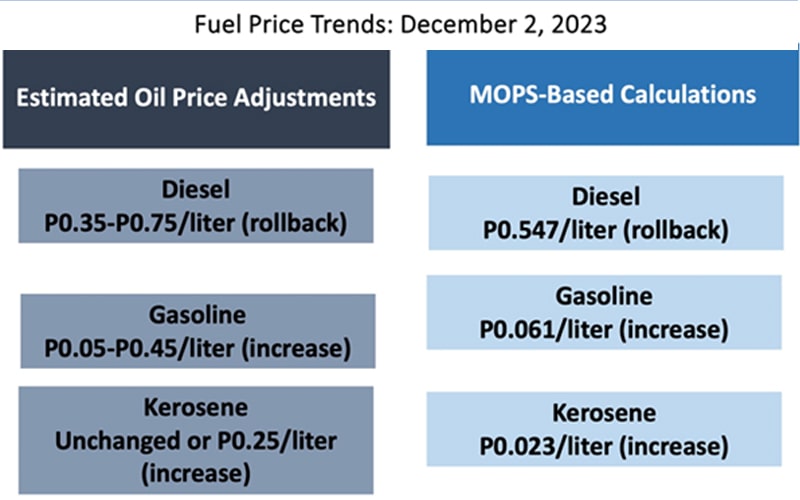

The price of diesel will be pared by P0.35 to P0.75 per liter; while gasoline prices will likely rise by P0.05 to P0.45 per liter, according to the industry players,

Kerosene, which is the other commodity in the triumvirate of weekly cost swings at the domestic pumps, will either have its price unchanged or there will be a very lean increase of P0.25 per liter.

The oil firms will be adjusting their prices on Tuesday (December 5) and it will be conventionally referenced on the Mean of Platts Singapore (MOPS), the pricing yardstick adopted by the deregulated downstream oil industry that has been anchored on the trading outcome of finished petroleum products in the regional market.

If reckoned solely on MOPS, the calculated price adjustments would be P0.547 per liter rollback for diesel; P0.061 per liter hike for gasoline; and P0.023 per liter increase for kerosene.

Prior to next week’s round of adjustments, a monitoring report of the Department of Energy (DOE) has shown that overall prices still logged net increases of P12.30 per liter for gasoline, P6.00 per liter for diesel; and P1.74 per liter for kerosene.

With no major events seen exerting upward pressure on prices in the remaining weeks of the year, consumers are hoping that fuel budget squeeze won’t be among those that will torment them during the Christmas holidays.

Global experts indicated that the decision of the Organization of the Petroleum Exporting Countries and ally-producers (OPEC+) to voluntarily cut production by 2.2 million barrels per day by the first quarter of 2024 had not done much to lift softening prices.

As agreed during the global producers’ meeting last November 30, Saudi Arabia is targeting to roll over its output cut of 1.0 million barrels per day; while Russia had given word on trimming production by 500,000 barrels per day.

As of Friday (December 1), international benchmark Brent crude still caved in at $78 per barrel level, as it was unable to sustain its rise to $80 per barrel mark in earlier trading days.

Industry watchers opined that by January next year, one major development that the international market will be keeping its eyes on would be Brazil’s entry as OPEC+ member, given its stature as South America’s largest oil producer. (with reports from Myrna M. Velasco/ MB)